Excerpt: Everybody is asking that question these days. The average nationwide price for all grades this week is $3.96/gallon; Californians are paying on average $4.26, the highest in the nation.

Why does it cost so much, especially considering that the price was below $2.00/gallon just within the last couple of years?

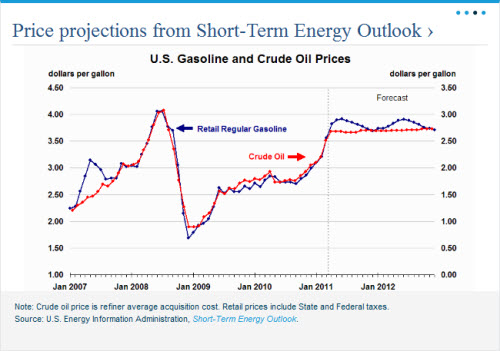

Nearly seventy percent of the price of a gallon of retail gasoline is the price of the crude oil it is refined from. Two graphs from the Energy Information Administration (EIA) make that point. The first shows the price of a gallon of gasoline (left axis) plotted against the price of a gallon of crude oil (right axis). The two move in virtual lock-step; if you know the crude oil price per gallon, add $1.00 and you’ll know the price of gasoline within a few cents. (At $105 per 42-gallon barrel, the per-gallon price of crude is $2.50; add a buck, and you get a gasoline price around $3.50.)

Read full Redstate article here.

No comments:

Post a Comment