Friday, January 4, 2013

1913 a very bad year for America

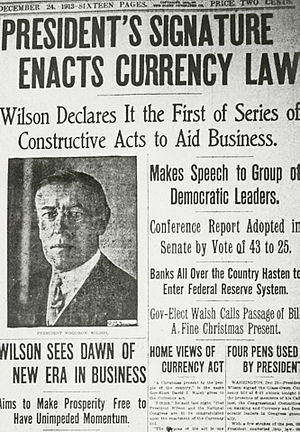

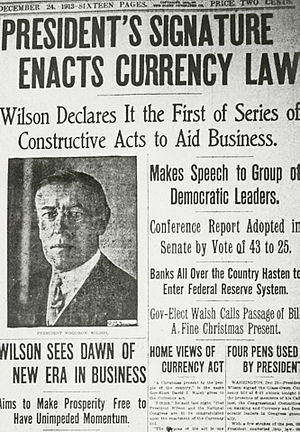

Description: Newspaper clipping USA, Woodrow Wilson signs creation of the Federal Reserve. Source: Date: 24 December 1913 (Photo credit: Wikipedia)

Repeal of the 17th Amendment, elimination of the Federal Reserve and Income Tax sounds like a good start to me.

Excerpt: 1913 would rank as an unlucky year if all that had happened was Wilson’s ascendancy to the presidency. Three things he helped give us that year, however, make it unforgettable in the most pejorative sense: the income tax, the direct election of U.S. senators, and the Federal Reserve System.

On February 3, a month before Wilson took office, the 16th Amendment to the Constitution was ratified. Strongly supported by Wilson, it authorized the federal government to impose and collect a tax on personal incomes. Subsequent legislation set the top rate at a mere 7 percent. Married couples were only taxed on income over $4,000 (about $90,000 in today’s dollars). When Wilson left office eight years later, the top rate was more than ten times higher.

The income tax granted politicians enormous power to reward friends, punish enemies, and redistribute wealth. It morphed into a more oppressive, productivity-sapping nightmare than even its most ardent opponents had warned Wilson against. Today’s massive IRS bureaucracy and incomprehensible, 73,000 pages of tax rules, regulations and IRS rulings are Wilson’s illegitimate children, born in 1913.

On April 8, the 17th Amendment to the Constitution was ratified, also with Wilson’s longstanding endorsement. Instead of being appointed by state legislatures as established by the Founders, U.S. senators would thereafter be chosen by popular vote. Since that process seems “democratic,” few people question the amendment’s wisdom today. The sad fact is that it seriously eroded the balance between state and federal governments to the great detriment of the former. It helped make the states into administrative drones for the queen bees in Washington, D.C. One example of its baleful influence: The explosion of unfunded federal mandates could never have occurred if U.S. senators were directly accountable to state legislatures.

The late columnist Tony Blankley wisely advised, “The most efficient method of regaining the original constitutional balance is to return to the original constitutional structure. If senators were again selected by state legislatures, the longevity of Senate careers would be tethered to their vigilant defense of their state’s interest—rather than to the interest of Washington forces of influence.” Repealing the 17th Amendment, he argued correctly, might be the best way to enforce the 10th Amendment, which states, “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

On December 23, Wilson’s signature enshrined into law the Federal Reserve Act, creating a central bank and more economic mischief than any other federal initiative or institution in the last 100 years.

Imagine if Congress had hired a private company to manage the nation’s money supply, protect the value and integrity of the currency, promote full employment, and iron out the boom-bust cycle. Imagine further if that company went on to generate a Great Depression, a slew of recessions and volatile swings in employment, and a dollar worth perhaps a nickel of its former value. We’d have long ago fired the company and jailed its executives. Yet that’s precisely the legacy of the Federal Reserve.

Without the 16th and 17th Amendments and the Federal Reserve, it’s inconceivable that the federal government could have grown from less than five percent of GDP in 1913 to nearly 25 percent in 2013. Were it not for those three gremlins, how many fewer trillions might our unconscionable national debt be? The toll on our liberties is also incalculable but surely considerable. It’s no exaggeration to say that 1913 is the year that keeps on stealing.

Read more here.

Labels:

Constitution,

Fed,

Federal Reserve,

Income Tax,

Taxes

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment